child care tax credit 2020

The Child and Dependent Care Credit is a tax credit that helps parents and families pay for the care of their children and other dependents while they work are looking for work or are going to school. Thanks to the American Rescue Plan signed by President Biden in March 2021 more families are eligible for the credit for the first time and.

Childctc The Child Tax Credit The White House

The Child Tax Credit is the credit for having a qualifying child dependent.

. In general for 2021 you can exclude up to 10500 for dependent care benefits received from your employer. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. The act extends the credit for 5 more years.

COVID-19 Stimulus Checks for Individuals. Child and Dependent Care Credit OR Early Childhood Development Tax Credit Only taxpayers with a net income of less than 45000 are eligible to take one of these refundable credits. A taxpayer who makes a monetary contribution prior to January 1 2020 to promote child care in the state is allowed an income tax credit that is equal to 50 of the total value of the contribution.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Calculating the child and dependent care credit until 2020. Starting in 2021 the Child and Dependent Care Tax.

The American Rescue Plan of 2021 increased this tax credit from previous years. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income. The Low Income Housing Tax Credit LIHTC was created by Congress under Section 252 of the Tax Reform Act of 1986 to promote the construction.

The credit will reduce the amount of New Jersey Gross Income Tax a taxpayer owes but wont result in a refund if no taxes are owed. It is a partially refundable tax credit if you had earned income of at least 2500. Everything we do is Designed to Help Children Grow 6 Key Areas of Childhood Development.

The credit doubles if the expenses are related to a quality child care provider. Income tax - child care contribution credit - extension. In 2020 for instance the CDCTC was 20 percent to 35 percent of qualified childcare expenses.

From july 15 families will receive up to 250 a month for children 6 to 17 and up to 300 a month for children under 6 through december. Child Care Tax Credit Calculator 2020. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The Low Income Housing Tax Credit Program LIHTC is a federally authorized program for non-profit and for-profit developers to promote the construction and rehabilitation of affordable rental housing. Only one of the following two credits may be claimed. Information on how to claim the 2020 Child and Dependent Care Credit can be found on page 34 of the 2020 NJ-1040 Instructions.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. The 2020 child tax credit is intended to help offset the tremendous costs of raising a child or children. Additionally in general the expenses claimed may not exceed the smaller of your earned income or your spouses earned income.

Credit for Child Care Expenses. This credit is equal to 25 of the federal credit for child and dependent care expenses. The percentage you use depends on your income.

For 2020 the credit was a maximum of 2000 only for children aged 16 or less as of 12312020 with a phase-out at higher income. 1400 in March 2021. If your income is below 15000 you will qualify for the full 35.

If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017 and earlier Tax Years the credit amount was 1000. Your child must be under age 13 or disabled to qualify for this credit. 1200 in April 2020.

600 in December 2020January 2021. This credit is also refundable up to 500. Ad For 50 Years weve Lead the Industry in Early Childhood Education with Our Curriculum.

For 2021 the credit is a maximum of 3000 per child who is aged 17. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

If you are married your net income and the net income of your spouse must be combined to determine if you qualify even if your spouse. The Child and Dependent Care Credit can be worth from 20 to 35 of some or all of the dependent care expenses you paid. If you or your spouse is a full-time student or incapable of self-care then you or your spouse is treated as.

The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children. Taxpayers may be able to claim the New Jersey Child and Dependent Care Credit if they. Moreover the maximum amount a taxpayer could claim was up to 3000 for one child and 6000 for two or more children.

The new child tax credit will provide 3000 for children ages 6 to 17 and 3600 for those under age 6. The percentage falls by 1 for every additional 2000 of income until it reaches 20 for an income of.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Tax Credits Excel Templates Federal Income Tax

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Child Tax Credit In 2022 Is Your State Sending 750 To Parents Find Out Now Cnet

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

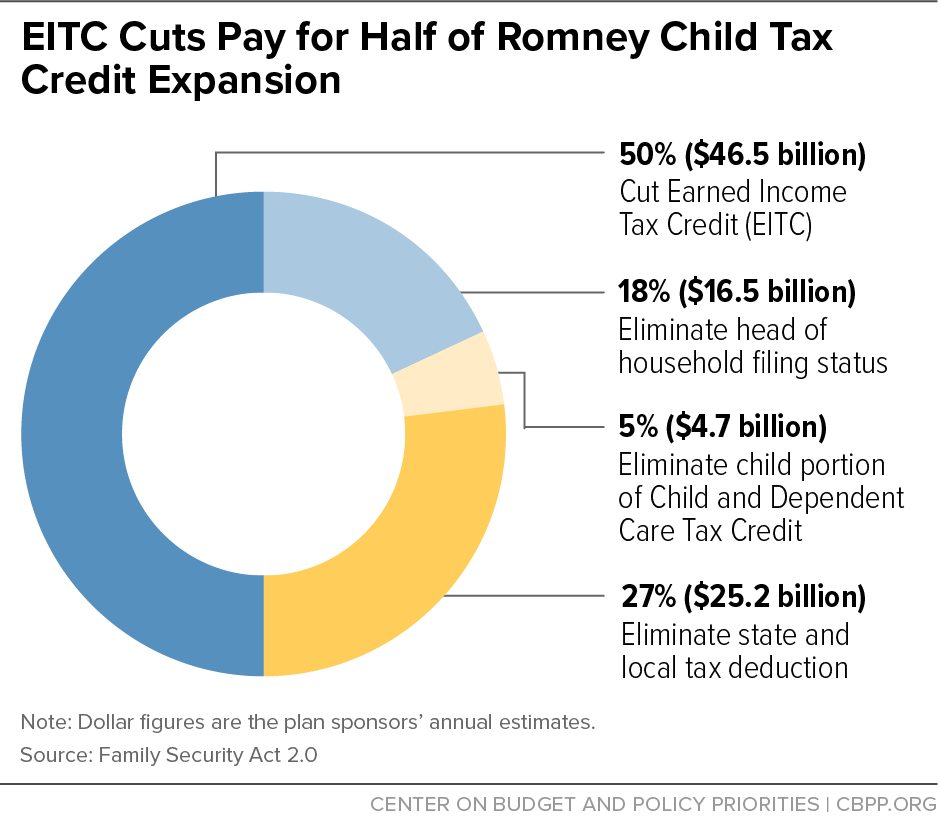

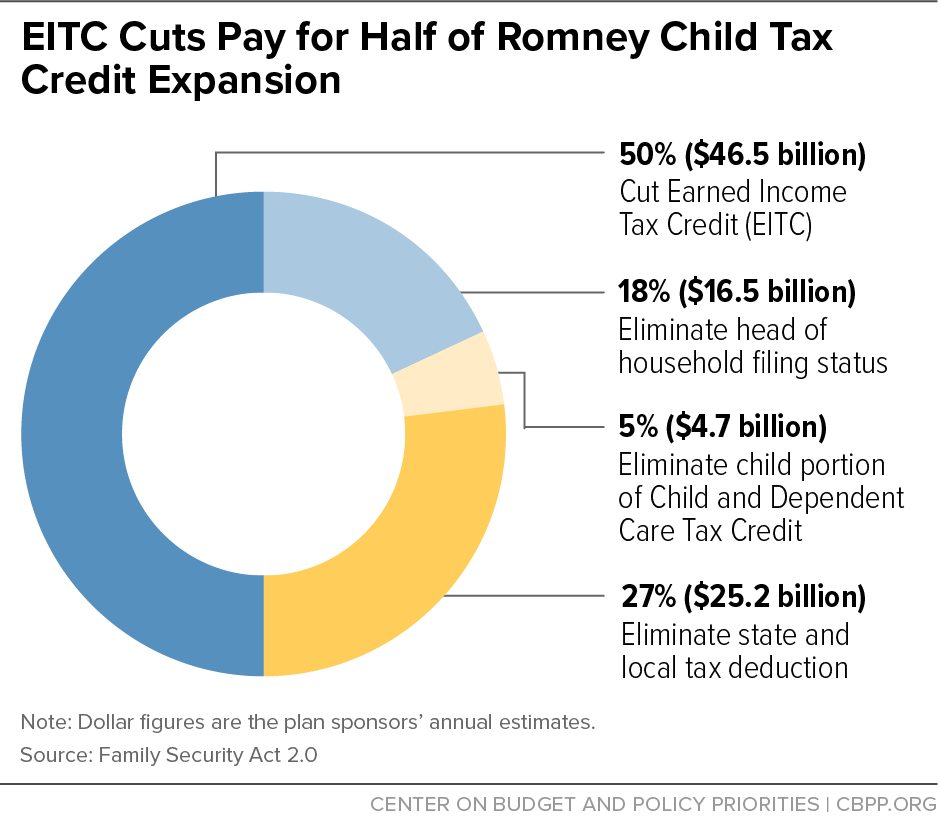

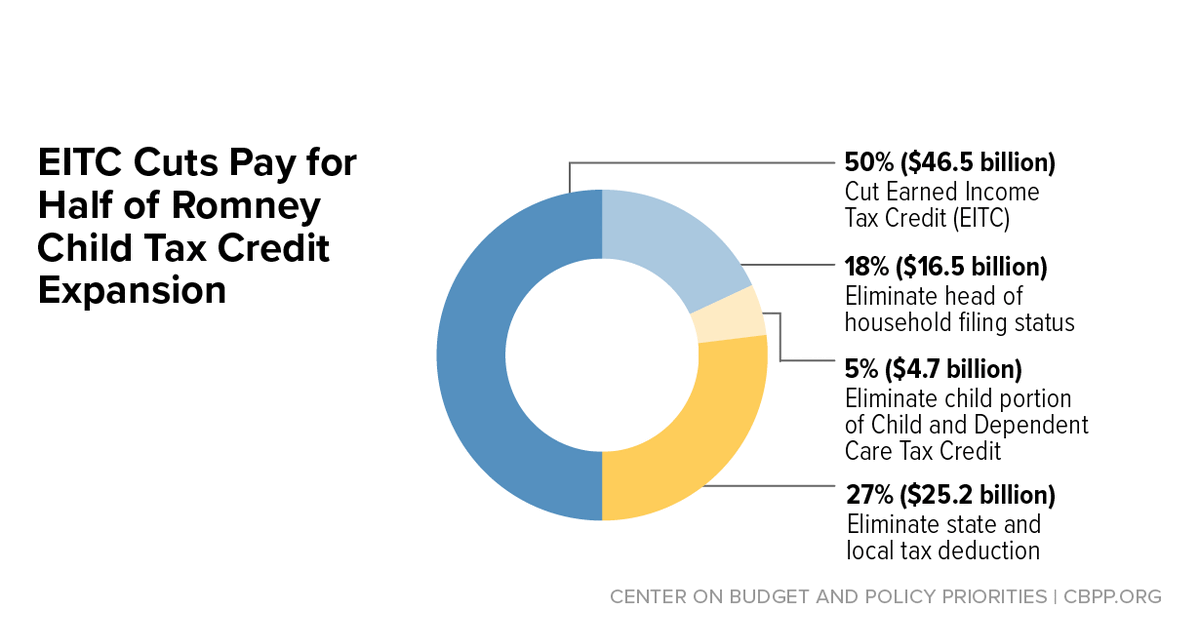

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

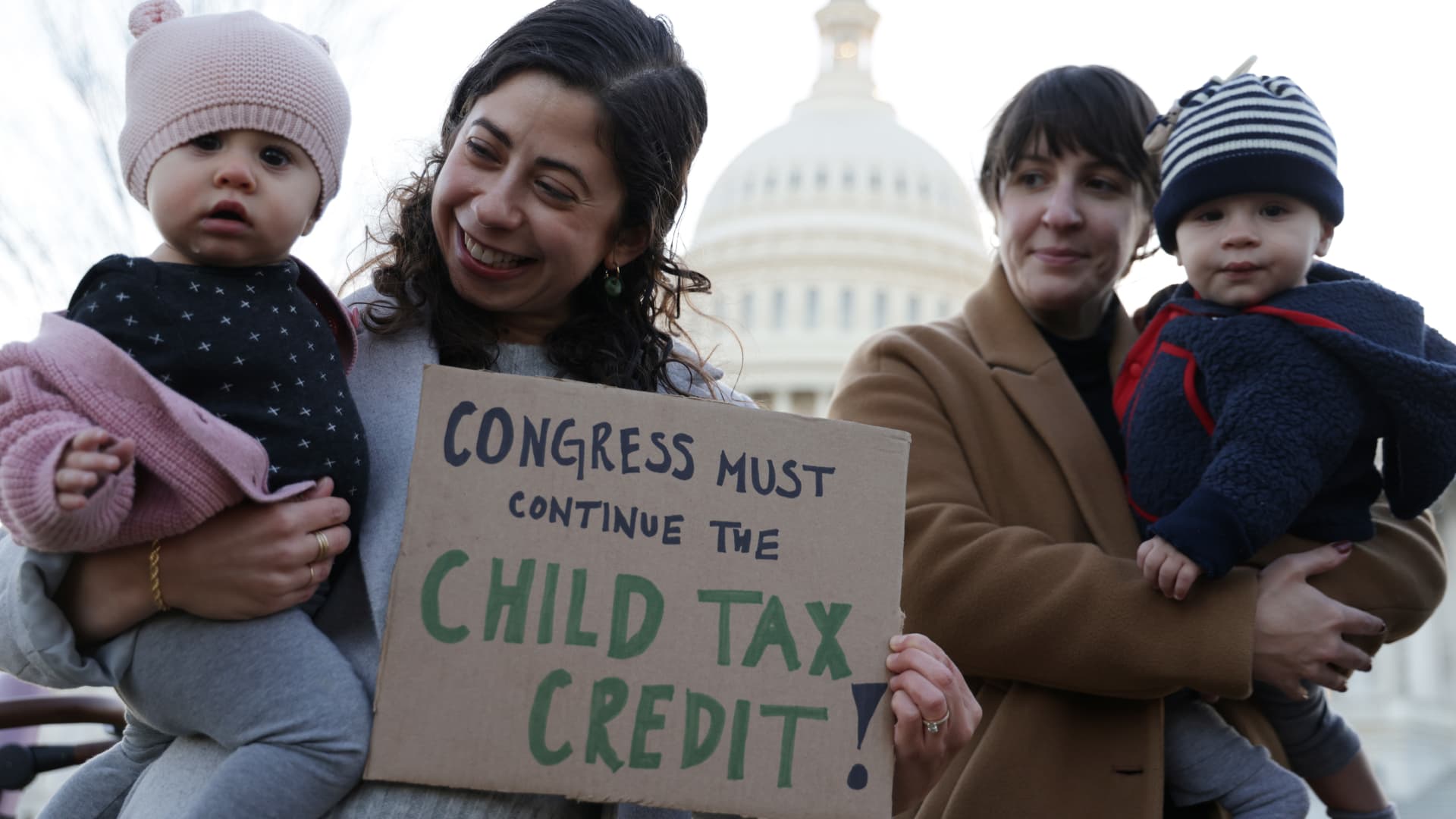

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)